Introducing Buyers Traffic +

Your Ultimate Traffic Solution!

Get Instant Access To Real Buyer Traffic!

Get More Signups & Sales.

Are you tired of struggling to drive traffic to your offers?

Say goodbye to your traffic woes with Buyers Traffic + With our simple and effective solution, you can finally take your online presence to new heights.

With Buyers Traffic + you’ll never have to worry about low traffic to your offers again.

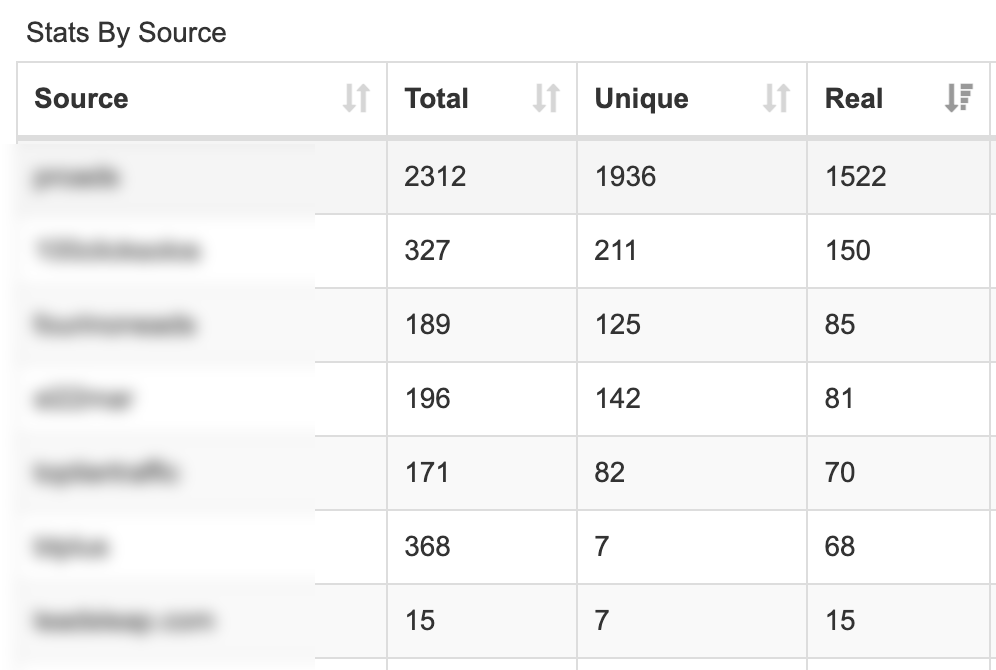

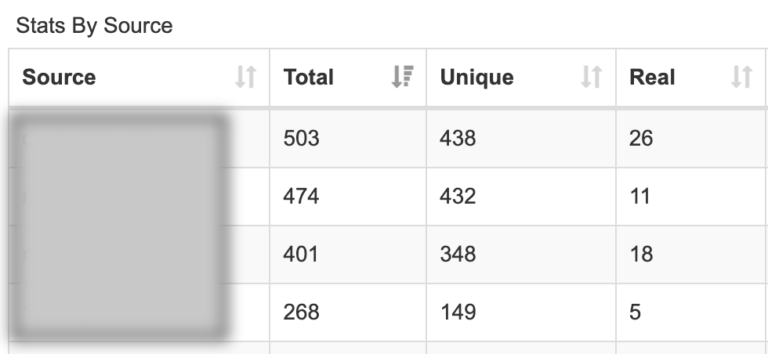

Our proven Strategies Guarantee a steady stream of visitors to your site, increasing your chances of success.

Register now and purchase our system to begin receiving clicks to your offers.

We offer high-quality traffic clicks to generate sales, commissions, and sign-up leads, tailored to suit every budget.

Lack of Engagement?

Boost engagement with Buyers Traffic + system. Focus elsewhere and watch engagement rise.

No Sales?

Utilize Buyers Traffic + system for real buyer clicks. Sit back and watch sales grow.

Instant Results

Don’t waste time waiting for results. With Buyers Traffic+ you’ll start seeing an increase in traffic to your offers from day one. It’s the quickest and easiest way to get noticed online.

High Quality Clicks

NO POP UP Traffic NO BOT Traffic NO FAKE Clicks

Qualtiy Leads

We add 250+ Leads Daily

Over 90%

Tier 1 Traffic

USA/CANADA

Support

We will help you with all your questions and problems

Let’s FIX Traffic Problems

No Traffic = No Sales

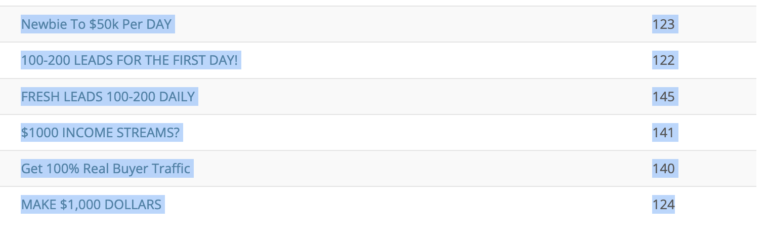

With Buyers Traffic + you will be getting targeted BUYERS TRAFFIC to any URL.

You will enjoy this traffic, DAY AFTER DAY, MONTH AFTER MONTH

No Commissions?

Optimize with Buyers Traffic + system.

Relax and monitor progress effortlessly.

Don’t miss out on this opportunity to skyrocket your online presence with Buyers Traffic + Click BUY BUTTON below to start driving traffic today!

Plus, get an exclusive BONUS instantly receiving 1500 fresh leads when you purchase our BT+ System!

With Buyers Traffic + you won't need to Spend time on Social Media Posts, Create Videos, Monitoring Click-through Rates, Run Facebook Ads, Pay for SoloADS Traffic, Worry about SEO, Build an Email List...

How To Order?

* Click on the “BUY NOW” button below and complete the payment process.

* Once payment is confirmed, you will be automatically redirected to a registration form.

* Register using the email registered on Warriorplus.

* Log in to your Buyers Traffic+ account to get started.

Sit back and enjoy your Buyers Traffic

each and every day FOREVER

Please Read Our Terms and Conditions

* We cannot guarantee conversions on your offers.

All we can guarantee is that you will receive the unique clicks you have paid for. Refunds are not granted once delivery has started.

* We do not offer refunds on delivered clicks.

* We only accept offers related to Internet Marketing, Biz Ops, Make Money Online.

support@buyerstrafficplus.click is our support email. If you ever need to reach support in the future, you must use this email address.

TERMS & CONDITIONS: BUYERS TRAFFIC PLUS is not a ‘get rich quick’ scheme. You understand and agree that there are important factors that should be considered when deciding whether to invest in any digital product or website. NO EARNINGS PROJECTIONS, PROMISES OR REPRESENTATIONS can be GUARANTEED. While my programs have created hundreds of success stories I have no idea of your experience, and more importantly your work ethic. You must recognize and agree that I have made no implications, warranties, promises, suggestions, projections, representations or guarantees whatsoever to you about future prospects or earnings, or that you will earn any money, with respect to your purchase of any of my products. Any earnings or income statements, or any earnings or income examples, are only estimates of what I think you could earn. Some of my students make no money, some make a little bit of money, some make a lot of money. What you earn will be down to a lot of factors that are out of my control.

Copyright © 2024 Buyers Traffic Plus. All Rights Reserved.